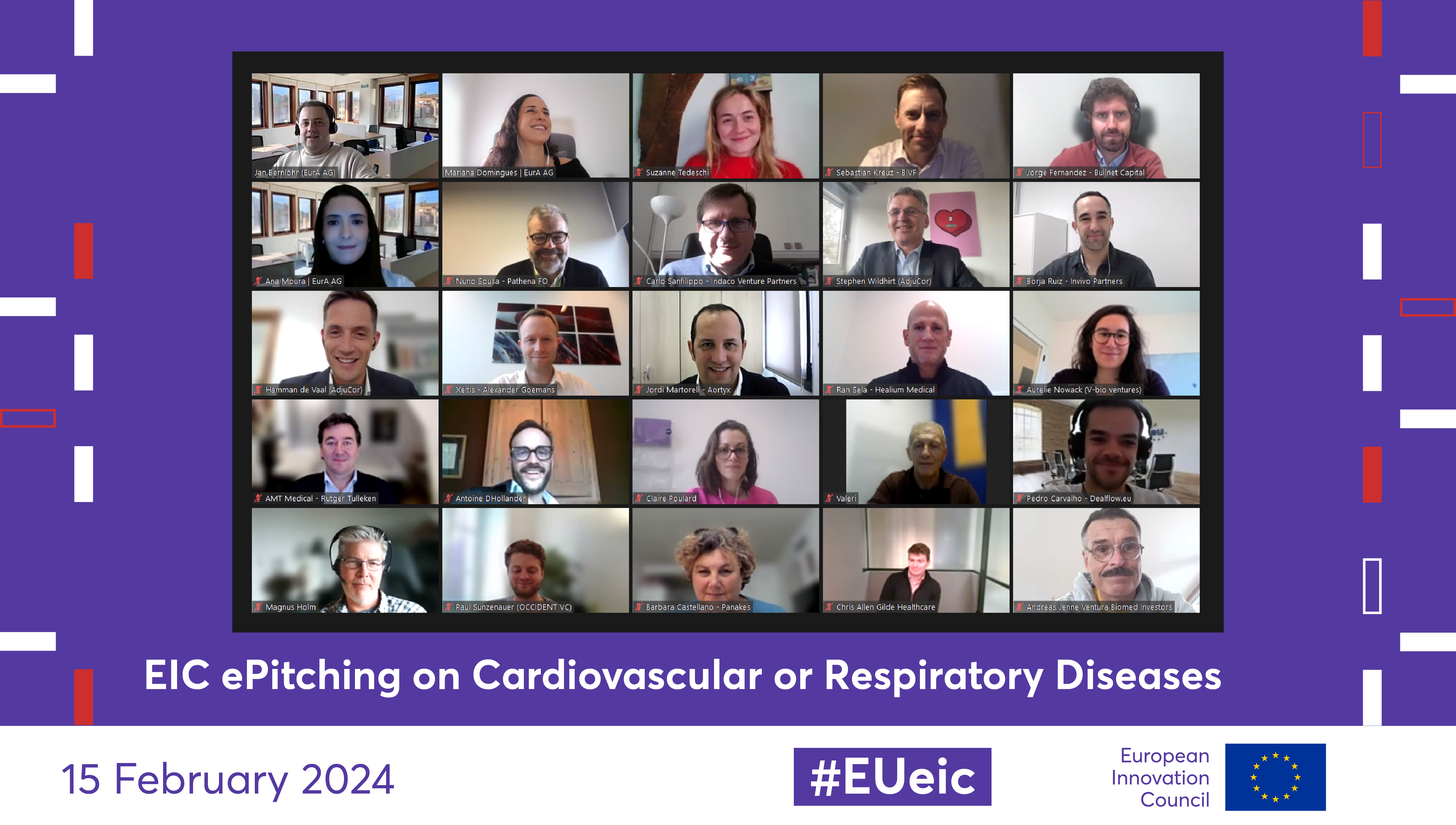

The European Innovation Council (EIC) curated a lineup of six companies tackling cardiovascular or respiratory diseases during a new ePitching. Over 30 investors participated in the session to explore pioneering ideas aimed at combating Europe’s foremost cause of mortality. The initiative was organized in the scope of the EIC Ecosystem Partnerships and Co-Investment Support programme, one of the EIC’s Business Acceleration Services (BAS).

Among the disruptive solutions showcased were technologies and products to fight advanced heart failure, presented by AdjuCor. Additionally, AMT Medical introduced a cardiovascular device for minimally invasive coronary bypass surgery, while Aortyx presented a new generation of biocompatible and bioabsorbable patches to treat aortic diseases.

Healium Medical proposed ablation procedures with advanced miniaturized ultrasound-guided therapeutic technology. Nimble Diagnostics showcased a solution for the non-invasive monitoring of patients with implanted stents, regardless of stent type or location, in less than five seconds. Finally, Xeltis has developed implants that facilitate the natural creation of living and long-lasting vessels and valves, aiming to enhance the lives of patients with hemodialysis or who need cardiovascular replacements.

AdjuCor, based in Munich, and Aortyx, headquartered in Barcelona, emerged as the best pitches of the day. In the aftermath of the session, we delved deeper into the status of both companies and gauged their overall impressions. Spoiler alert, both companies highlighted the ratio of investors and are eagerly looking forward to funding opportunities.

Innovations in end-stage heart failure treatment

As a cardiac surgeon with extensive experience in heart failure surgery and heart transplantation, Stephen Wildhirt, CEO and co-founder of AdjuCor, performed over 2,000 open-heart surgical procedures.

The company made its first steps ten years ago when Stephen concluded that many patients were not being treated. “The idea was to find a solution to provide mechanical circulatory support, not to the heart but to the circulation, but maybe also to the heart, without contacting the blood,” recalls Stephen.

“There's no treatment option at all because heart transplantation is short because of donor shortage”, points out the former surgeon. “The second major medical issue is blood contact with foreign services. When you use blood pumps or any other technologies which are always associated with either complications, associated with blood, for example, thrombosis or if the blood is thin, then you have bleeding complications,” exemplifies AdjuCor’s CEO.

The idea had four prototype development phases behind it. Now, the prototype development phases have taken place. reBEAT is now at the product phase “where we solved in our opinion all problems related to this new technology.” AdjuCor entered “the first in human clinical Study, world's first in human, I should say with technology in June 2023, we did the first patient and now we have done seven patients with this technology to assess feasibility, safety, and performance. And we have 100% success so far.” You may check the product’s video here.

The company is currently seeking an investment of €35 million, with €20 million to be contributed by a new investor and €15 million to be mirrored by the EIC Fund or the European Investment Bank.

“We were excited that we were selected for this event. There was a good ratio of investors. We are looking, without pressure, for a new investor. This will probably be the last investment before we get into the reimbursements. So, it will be a major round Series B round,” explains Stephen Wildhirt, CEO and co-founder of AdjuCor.

Bridging Academia and Innovation: Aortyx's Journey to saving lives

After completing his PhD on the correlation between Vascular Biology and Fluid Dynamics, Jordi Martorell, CEO and co-founder of Aortyx, shifted his focus to aorta diseases due to the pressing medical need that he observed. Working with a physician, he found a case of aortic dissection that compelled him to act.

“There was a hole, and the team was debating whether we should close it or not. As an engineer, my reaction was: ‘you should cover that hole. Period.”, Jordi recalls. “But because the solutions were inadequate, I realised that many patients were not even treated. That was extremely shocking” explains Jordi. Determined to address this unmet medical need, Jordi embarked on his journey of research and innovation.

Aortyx was born in 2018. Its flagship product is an endovascular patch designed to treat aortic dissection. Over five years, the team has grown from four to 20 members. “That was the only way for our idea and the whole development to reach the target which are our patients and our physicians. That is the only real way to make it to the world,” declares the company’s co-founder.

According to Jordi Martorell, what sets this patch apart from other solutions is its ability to intervene in more patients than the solutions available in the past. With a small-sized patch rather than a large device with complex geometry, the holes can be covered, non-invasively. Additionally, it respects the mechanical biomechanical environment of the aorta, leading to lower reintervention rates and less mortality.

Aortix is currently seeking Series A funding with a targeted amount of €17 million, and they are hopeful that the EIC ePitching will catalyze their next steps.

“The ratio of companies to investors present was the highest I have ever seen. It is encouraging to see that investors were actively engaged, as evidenced when we got their questions”, remarked Jordi Martorell, CEO and co-founder of Aortyx.

The selected EIC Fund companies had the opportunity to pitch to a jury of investors from Amadeus Capital Partners, Apollo Health Venture, BioGeneration Ventures, Bionova Capital, Böhringer Ingelheim Venture Fund, Bullnet Capital, Capricorn Partners, Eleven Ventures, Hadean Ventures, High-Tech Gründerfonds, Indaco Venture Partners, Invivo Capital, Karista Ventures, Kurma Partners, MIG AG, Novo Holdings, Panakès Partners, Pathena Investments, Peppermint Venture Partners, Supernova Invest, Turenne Capital, V-Bio Ventures, Vesalius Biocapital, Ventura Biomed, Xange, and Ysios Capital.

Investors’ Feedback: “High quality and diverse range of companies”

To Barbara Castellano, Partner at Panakès Partners, “the session had a good mix of companies. They touched on a lot of different needs in the Cardiovascular space, aortic dissection, atrial fibrillation, heart failure, coronary artery disease (both coronary bypass and stenting), proposing a way to improve the treatment or diagnosis of those diseases. The clinical need and the target applications were clear. Believe me, it is not always easy to get good pitches. And the pitches were good. Also, the discussion went well with an interesting flow of questions and answers”.

Panakès Partners, a Milan-based Venture Capital firm, seeks ambitious companies and teams, developing revolutionary technologies and products in the field of life sciences.

With over €250 million under management, Panakès looks for companies addressing clear unmet clinical needs within targeted market segments. Strong and dedicated teams are one of the most important factors in the success of a start-up.

“Also, good knowledge of competitive environment, clear indications about the stage of project development and clear description of next steps and use of proceeds are key requirements in a pitch, and I observed those points in nearly all the presenting companies today,” Barbara assured.

The quality of the companies presenting, and the overall event was also pointed by Guillem Laporta, Partner at the Spanish Ysios Capital.

“The companies were of high quality. There were a couple of them that I liked over the others, but in general, I must say that it was a particularly good event and very well organized,” Guillem stated.

For the Ysios Capital Partner, one additional highlight of the session was the fact that the also Spanish-based Aortix won the ePitching competition (tied with AdjuCor) and they were immediately introduced in the aftermath of the event, during a one-on-one meeting.

As food for thought, Laporta advises entrepreneurs to consider strategies to differentiate themselves from other existing products in the market, right from the outset of their journey. Furthermore, Guillem suggests that companies closely monitor competitors and upcoming products in the pipeline, particularly those awaiting approval. He emphasizes the importance of projecting how the market will evolve over the next decade. “Companies need to do this exercise and be able to pitch their differentiation points in a way that it's very clear,” he concludes.

Discover the selected companies that pitched during this session

Learn more about the companies who attended the session here.

This event was organized under the EIC Ecosystem Partnerships and Co-Investment Support programme. The next pitching event under the programme will focus on Sustainability & Deep Tech. Read additional details here.

About the EIC Ecosystem Partnerships and Co-Investment Support Programme

The Ecosystem Partnerships and Co-Investment Support Programme is expanding the EIC’s Business Acceleration Services (BAS) by creating a network of specialized, sector-focused partners that can help innovators access the services they need. It is also dedicated to promoting co-investment along with the EIC Fund, by preparing beneficiaries to interact with investors and connecting them through matchmaking and dedicated events.

Should you have any questions regarding the event, please contact us by email: investments@eicfund.eu.

DISCLAIMER: This information is provided in the interest of knowledge sharing and should not be interpreted as the official view of the European Commission, or any other organisation.